- The Weather Channel Desktop can also be called 'Desktop Weather by The Weather Channel'. This free software is an intellectual property of The Weather Channel Interactive. Our built-in antivirus scanned this download and rated it as virus free.

- Accuweather app free free download - AccuWeather, AccuWeather, AccuWeather, and many more programs. Get the current Weather and Weather forecast. Free Publisher: Mg2 Downloads: 4,507.

Our antivirus analysis shows that this download is clean. The program lies within Home & Hobby Tools, more precisely Weather. This free software is an intellectual property of The Weather Channel Interactive, Inc. The latest version of the program can be downloaded for PCs running Windows XP/Vista/7/8/10, both 32. Download our free cash flow forecast template in Excel. It is perfect for sole traders, freelancers and small businesses in the UK.

Forecast is the fast and simple way to schedule your team across projects.

Visualize your plans.

Map out your plans and see them with clarity in Forecast. Know how busy or available your team is at a glance. Keep key dates on top of everyone's minds as you push projects forward.

With two ways to view your plan, the schedule is clearer than ever.

Everyone on the same page.

What type of keyboard is on a macbook pro. Collaborate with project managers and share the plan with the entire team. With Forecast as the central place for your plans, there's minimal confusion about who's working on what and when.

A modern tool designed for the job.

Forecast App Download Free

Leave bloated spreadsheets behind. Forecast is designed from the ground up for this job. The intuitive and thoughtful interface makes scheduling and planning an enjoyable experience.

'We'll need a few more days…''Done.'Review real-time project progress.

Will the project go over budget? Are the estimates close to the actuals? Get the full picture of your projects when you combine Harvest time tracking with Forecast time planning.

Start with a free 30-day trial.

Questions? Just contact us.

Multipart article

by Andy Marker on May 08, 2017

Wing ide 6 1 5 x 8. A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The term 'cash' refers to both income and expenditures and may include investments and assets that you can easily convert to cash. By conducting a cash flow analysis, a business can evaluate its liquidity and solvency, compare performance among accounting periods, identify cash flow drivers to support growth, and plan ahead to maintain a positive cash position.

Below you'll find a collection of easy-to-use Excel templates for accounting and cash flow management, all of which are fully customizable and can be downloaded for free.

Elements of a Cash Flow Statement

A cash flow statement is typically divided into the following sections to distinguish among different categories of cash flow:

- Operating Activities: Cash flows in this section will follow a company's operating cycle for an accounting period and include things like sales receipts, merchandise purchases, salaries paid, and various operating expenses.

- Investing Activities: Some examples of investing activities include buying or selling assets, making loans and collecting payments, and generating cash inflows or outflows from other investments.

- Financing Activities: This section may include activities such as receiving money from creditors or shareholders, repaying loans and paying dividends, and selling company stock, as well as other activities that impact equity and long-term liabilities.

A statement of cash flows can summarize information for any accounting period, but if you're starting a new business or planning for the months ahead, creating a cash flow projection can help you anticipate how much money your business will have coming in and going out during a future time frame.

Creating a Cash Flow Forecast

Projecting future cash flows can give you greater financial control, provide a deeper understanding of a company's performance, help identify shortfalls in advance, and support business planning so that activities and resources are properly aligned. New businesses trying to secure a loan may also require a cash flow forecast.

In order to set yourself up for success, it's imperative to be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it's important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It's also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: The closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, and upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

Excel Bookkeeping and Cash Flow Templates

To help you get started creating a cash flow statement or forecast, we've included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience. Each template offers a clean, professional design and is intended to save you time, boost efficiency, and improve accuracy. Just enter your financial data, and the templates will perform automatic calculations for you to analyze. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance. Smartsheet offers additional Excel templates for financial management, including business budget templates.

Accounts Payable Template

This accounts payable template tracks suppliers, order numbers, and amounts due to help you manage payments and due dates. Easily organize ordering stock or supplies from multiple vendors with this template for greater efficiency and fewer errors.

Download Accounts Payable Template

Excel | Smartsheet

Accounts Receivable Template

Don't let balances owed to your business slip through the cracks. This template accounts receivable template lists customers, invoice tracking details, amounts due, and outstanding balances. Keeping track of these accounts can inform your collections process by helping you quickly identify which overdue payments have aged significantly.

Download Accounts Receivable Template What program do i need to open a rar file.

Excel| Smartsheet

Balance Sheet Template

A balance sheet provides a summary of financial health in a single, brief report. With this balance sheet template, you can assess the financial standing of a business by examining assets, liabilities, and equity. Business owners can use it to evaluate performance and communicate with investors.

Download Balance Sheet Template

Excel | Smartsheet

Income Statement Template

Use this income statement template to assess profit and loss over a given time period. Ifinance 4 5 18 mm. This template provides a clear outline of revenue and expenses along with net income figures. You can edit the template to match your needs by adding or removing detail, and create an income statement for a large or small business.

Download Income Statement Template

Excel | Smartsheet

Simple Cash Flow Template

This template works for any length of time and allows you to compare different periods for a quick analysis of cash flows. It include sections for an itemized list of revenue and expenditures, automatic calculations of totals and net cash flows, and a simple layout for ease of use. You can modify the template by adding or removing sections to tailor it to your business.

Download Simple Cash Flow Template

Excel | Smartsheet

3-Year Cash Flow Statement Template

Use this statement of cash flows template to track and assess cash flows over a three-year period. The template is divided into sections for operations, investing, and financing activities. Simply enter the financial data for your business, and the template completes the calculations.

Download 3-Year Cash Flow Statement Template

Excel | Smartsheet

Monthly Cash Flow Template

This comprehensive template offers an annual overview as well as monthly worksheets. Create a detailed monthly cash flow report to analyze performance or plan for the future. Each month has a separate sheet so that you can get a thorough picture of cash inflows and outflows for both short- and long-term periods.

Daily Cash Flow Template

Add receipts and payments to this daily cash flow template to get a deep understanding of business performance. Chrono plus 1 2 1 download free. You can customize the list of cash inflows and outflows to match your company's operations.

12-Month Cash Flow Forecast

Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. You get a snapshot of cash flows over a 12-month period in a basic Excel template.

Download 12-Month Cash Flow Forecast

Excel | Smartsheet

Quarterly Cash Flow Projections Template

Cash flow projection templates can cover a variety of time frames, including the quarterly format offered here. Quarterly projections are useful for new businesses and those wanting to align cash flow projections with upcoming goals and business activities. Use the template to create projections and then compare the variance between estimated and actual cash flows.

Cash Flow Analysis Template

You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions.

Discounted Cash Flow Template

This template allows you to conduct a discounted cash flow analysis to help determine the value of a business or investment. Enter cash flow projections, select your discount rate, and the template calculates the present value estimates. This template is a useful tool for both investors and business owners.

Nonprofit Cash Flow Projection Template

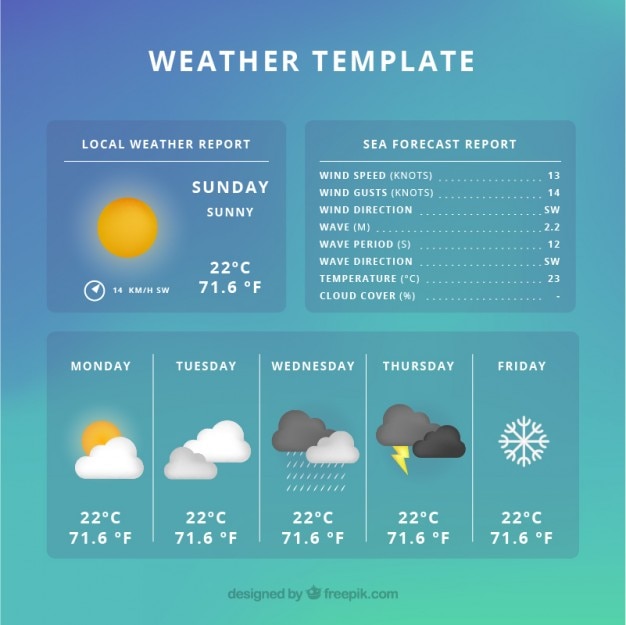

Free Download Weather Forecast Software

This template is designed with nonprofit organizations in mind and includes some common income sources, such as donations and grants, as well as expenditures. The template covers a 12-month period and makes it easy to see annual and monthly carryover so that you can track a rolling cash balance. Create a detailed list of all receipts and disbursements that are relevant to your organization.

Personal Cash Flow Template

Individuals can manage their personal cash flow with this free template. The simple layout makes it easy to use and provides a financial overview at a glance. Keep track of how you are spending money to gain more control over your financial habits and outlook.

Trial Balance Worksheet

Use this trial balance template to check your credit and debit balances at the end of a given accounting period, and to support your financial statements. The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference. This is a simple worksheet that you can customize to reflect your business type and the products or services it offers.

Download Trial Balance Worksheet

Excel | Smartsheet

A More Collaborative Cash Flow Statement Template in Smartsheet

Using a template is essential to helping you get started managing your organization's financials quickly. But, creating and managing your cash flow statement may require multiple stakeholders to weigh in and make updates. That's why it's important to find a template with more advanced functionality like notifications and reminders and enhanced collaboration features to ensure everyone is kept in the loop. One such template is the cash flow statement template in Smartsheet.

A Smartsheet template can improve how your team tracks and reports on cash flow - use row hierarchy to sum line items automatically, checkboxes to track stakeholder approval, and attachments to store item details directly to the rows in your sheet. Easily create reports to roll up annual, quarterly, or monthly cash flow details so you'll always have a real-time view of the financial health of your business.

See how easy it is to track and manage your cash flow statement with a template in Smartsheet.

A Better Way to Manage Accounting and Finance Processes for Companies of All Sizes

The good news is, that you can use Smartsheet for more than just a cash flow statement template. Smartsheet is a work management and automation platform that enables enterprises and teams to work better. Accounting and finance teams around the world use Smartsheet to track and manage annual audits, create balance sheets and income statements, manage cash flow, and complete financial month-, quarter-, or year-ends.

As a cloud-based platform, you can keep all accounting data stored in one centralized location, and share the details with internal and external stakeholders. Plus, with Smartsheet Dashboards, you can create custom dashboards to report on financial records, surface key performance metrics, and make decisions faster. The highly configurable dashboard pulls data from your existing sheets and is customizable with a simple drag-and-drop interface.

Noise generator online. Dashboards give you unprecedented, real-time visibility into your records, which boosts decision-making speed, communication, and overall performance.

Discover how easy it is to manage your accounting and finance processes in Smartsheet.